Starting a Business

Sioux Falls Business Lawyers

Leading the Way for Your Business

Get your business on the right track, right away. When forming a new business, there are numerous considerations to make. Our Sioux Falls business attorneys don’t complicate the heck out of things, but we do make sure you do it right so that you are maximizing your future value, paying less in taxes, and laying a good foundation for asset protection planning so that you protect yourself and the wealth you are building.

We counsel business leaders and entrepreneurs to maximize the most of out of your business and your private wealth. From strategic formation to brand protection, corporate restructuring to business transitions and succession, we’ve got you covered. We might be located in Sioux Falls, South Dakota, but we can assist you with your business in Iowa, Minnesota, Nebraska, and North Dakota as well.

What We Offer

- Innovative solutions that add value, efficiency, and budget predictability.

- Suite of pricing so you can select the package and services you want with value-based pricing so you know upfront how we price our services.

- Our Sioux Falls business lawyers collaborate with you to help find new ways to identify solutions and new business opportunities, across industries. We strive to be more than just lawyers, we are advisors bringing new ideas to light. We understand what keeps you up at night and work collaboratively to find practical and creative solutions, at the heart of business.

How Can Our Sioux Falls Business Lawyers Help?

We can provide efficient and professional guidance when forming your business to ensure you are appropriately registered, organized and meeting with all other regulatory requirements. When choosing a business entity, you should consider tax efficiency, asset protection, regulatory requirements and organizational structure. Our Sioux Falls business attorneys have full knowledge of corporate law and can assess your unique needs and help you with your business entity selection.

- Corporations: We can help with incorporating documents and filings to create your corporation. While the articles of incorporation are the first step, there are many steps thereafter that need to be taken in order to make sure you are protected and your corporation is setup correctly and operating correctly in the future. Having by-laws and structuring things like a buy-sell agreement if you have multiple shareholders are critical. Our Sioux Falls business lawyers help guide clients through governing law provisions, tax options, and asset protection planning. It is important to startup a business correctly as often it is much harder to cleanup things after something has gone wrong.

- Partnerships: Partnerships involve two or more individuals who have ownership stake in a business. Partnerships can vary wildly in complexity depending on scale and underlying business. Having a robust partnership agreement will help all partners govern transparently and fairly. Your partnership agreement should include mechanisms for making decisions and resolving disputes. A general partnership does not offer any liability protection. In today’s world, it is smart for business owners to create limited liability partnerships or limited liability limited partnerships for asset protection.

- Limited Liability Companies: A limited liability company is often a preeminent business entity to select for asset protection purposes and ease of administration. An LLC is a business classification that limits its members’ personal responsibility to the entity’s liabilities and losses. LLCs are also a popular choice of business entities thanks to their flexible management structure and relatively minimal administrative requirements. LLCs can have one business owner or can have multiple business owners. An LLC operating agreement is the governing document that outlines the business’ organization structure, each member’s rights and obligations, and include the governing terms for the members. Our Sioux Falls business attorneys can help you create an LLC that still can have the tax benefits of an s-corporation and the limited liability benefits of an LLC.

- Business Entity Conversions: Our Sioux Falls business lawyers can help you convert your business entity. As your business evolves, you may wish to convert your company into a different type of business entity. This can typically be done without dissolving your current entity and creating a new one. Our business lawyers can advise on conversion options and assist you with creating a plan of conversion, articles, and certificates of conversion.

Our Experience

Our Sioux Falls business attorneys create individualized plans for business owners tailored to their needs and the needs of their business. Once the business is up and running, we can help with annual obligations and planning opportunities. At Legacy Law Firm, our business attorneys use cutting-edge legal and tax planning techniques to help guide our clients in making prudent business, financial and personal decisions. We can help you at start-up, succession, and every stage in between. In short, we can help you obtain the greatest possible return on your investment.

South Dakota is one of the top states to start a business and create an LLC. Working with a South Dakota business lawyer is essential to making sure that your business is operative and in compliance with laws and regulations, and will protect you and your business. Many people will seek advice on what type of business entity is right for them. A business formation attorney will help guide you as to whether a sole proprietorship, partnership, LLC, c-corporation or s-corporation, or non-profit makes the most sense. Business incorporation is typically just the first step for business owners developing a new company as a business entity. How you choose to incorporate a business is going to boil down to taxes, asset protection, record-keeping abilities, and other factors. Our skilled South Dakota business attorneys know how to successfully start an LLC or other business entity formation and then help your business at every stage of growth. Avoid traps and headaches by having a team of experienced Sioux Falls business lawyers helping you.

Our Business Planning Services Include:

- Business Formations of Limited Liability Companies, S-Corporations, C-Corporations, Partnerships and Limited Liability Partnerships

- Asset Protection Planning

- Business & Wealth Tax Planning

- Structuring Redemption Agreements, Option Contracts, Shareholder Agreements, Buy-Sell Agreements and Rights of Refusal

- Separating Ownership and Control

- Entity Status, Subchapter S Elections, Limited Liability Companies and Family Limited Partnerships

- Business Trusts and Real Estate Trusts

- Employee Ownership Structures

- Private Split-Dollar Arrangements and other Advanced Funding Mechanisms

- Succession Planning for Closely-Held Business Interest

- Board Structure and Governance Issues, before, during and after Intergenerational Transfers

- When and How to Sell Your Business

- Phantom Stock Plans, Deferred Compensation and Golden Parachute Plans

- Equitable Planning for Children Involved in the Business and Children Not Involved

- Crypto Currency Holding Companies

- 1031 Exchange Agreements

- Series LLC

- Federal Reporting Requirements

Frequently Asked Questions

What should I consider when starting a business?

When deciding to start a business, it is important to consider the different types of business entities and determine which one is the right fit for your business. Common business entities include sole proprietorships, limited liability companies (LLCs), corporations, and limited liability partnerships. When determining which business entity is right for you, you should consider the number of owners, asset protection, how you would like to allocate profits and losses, and how you would like the business to be taxed. If you have employees, it’s important to have the right handbook and policies in place.

Do I need to hire a business attorney if I want to start a business?

While you can start your business without the help of a business attorney, an experienced business attorney can be incredibly valuable to your business. A business attorney can help you determine which type of business entity is right for your business and explain the pros and cons of each type of business entity. A business attorney can also work with you in drafting your internal business documents, contracts, and advise you on important decisions that can have serious ramifications. When starting a business, a business attorney may be one of the best investments a business owner can make.

What is a sole proprietorship?

A sole proprietorship is a business that is owned by one person and is not a legal entity. This form of business is simple, but it does not offer liability protections for its owners. The business owner reports all profits and losses on his or her individual tax return. All debts are the responsibility of the business owner, personally.

What is a limited liability company (LLC)?

A LLC limits the personal liability of the business owner so that the business owner’s personal assets are protected and kept separate from any debt of the business. LLCs are often an optimal business entity choice because of the asset protection and ease of corporate formalities.

What is a C corporation?

A C corporation involves three groups of people: 1) shareholders are the owners, 2) directors are responsible for management of the business, and 3) corporate officers, who are in charge of everyday operations, like the CEO and CFO. Unlike other business entities, a corporation has corporate formalities, such as annual meetings and annual minutes, which need to be followed in order to maintain proper business records and comply with laws.

What is a S corporation?

A S corporation is usually thought of as a tax election that can be made by qualifying business entities. Most commonly, “S” tax elections are made by either a LLC or a corporation. A S tax election may offer income tax and/or employment tax planning opportunities for its owners.

What is the difference between a C corporation and a S corporation?

In short, the difference is taxes. A C corporation will pay taxes on its profits, and then when it pays out dividends to the shareholders, the shareholders will pay taxes for the income they received on their individual tax return. S corporations do not have the double taxation and only shareholders will pay taxes on the income.

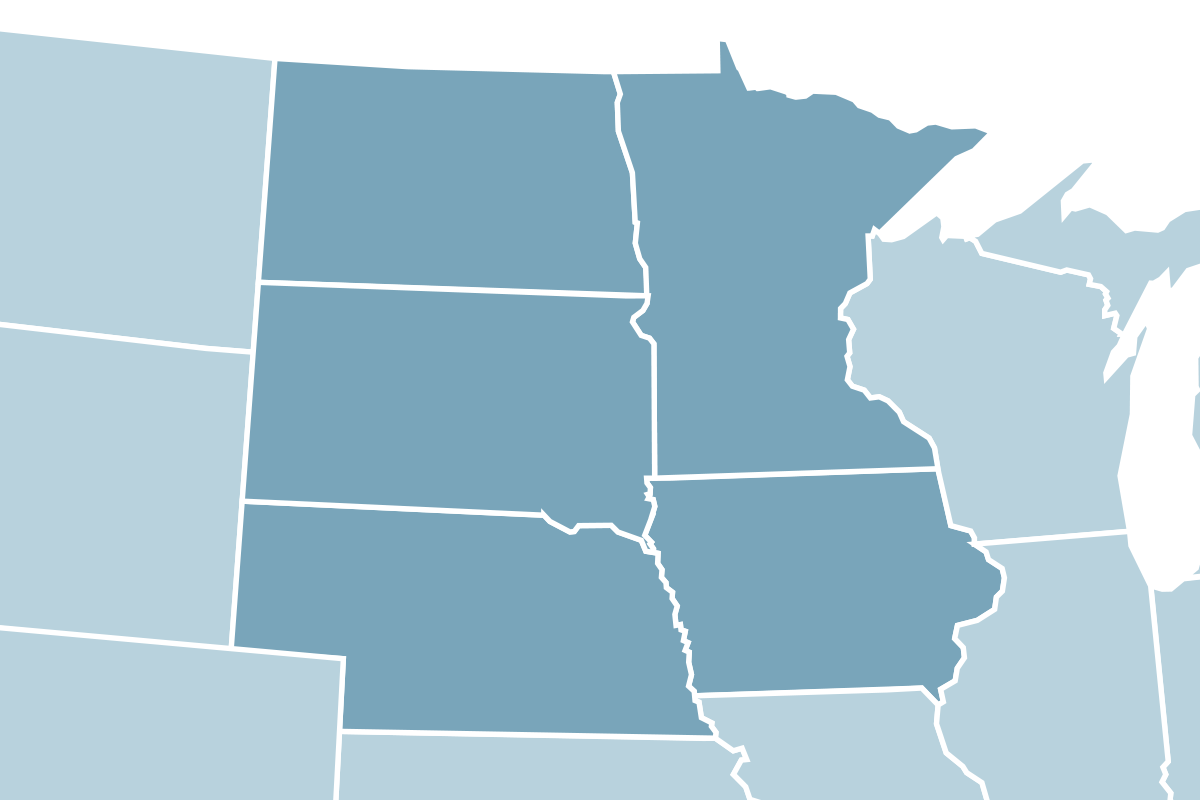

Locations We Serve

Legacy Law Firm offers legal services in estate planning, asset protection, elder law and trusts to individuals and businesses throughout the Midwest. We currently practice in these states:

- South Dakota

- Iowa

- Minnesota

- Nebraska

- North Dakota

Related Expertise

Read Our Blog

We’re committed to providing value at every turn. Check out our blog page for helpful resources.