Trust Administration

Sioux Falls Trust Administration Attorneys

Trusts can accomplish a wide range of important estate planning goals. However, many people assume that once they have created and funded a trust, it will simply take effect “automatically” when the maker of the trust passes away. This is not the case. A trust must be properly administered for it to work the way it was intended and carry out the trustmaker’s wishes.

It is important to note that failing to properly administer a trust can have serious legal and financial consequences for the trustee and the beneficiaries. If you have been asked to serve as trustee, don’t take the decision lightly. Our Sioux Falls trust attorneys can explain the steps involved in the process, and the potential risks for administering the trust improperly. If you do indeed want to serve as trustee, we can guide you every step of the way to ensure the directives of the trust are carried out accurately and appropriately. If you would rather not accept the role of trustee, we can help you choose the ideal person or institution to do so in accordance with the provisions of the trust and state laws.

Get the assistance you need in administering your South Dakota trust. Call (605) 275-5665 or contact us online to learn more about how we can help.

Frequently Asked Questions

What is trust administration?

Trust administration is the process that unfolds after the death of the grantor, the individual who created the trust. It entails the management and distribution of assets held within the trust, payment of expenses, and adherence to the specific terms and directives laid out in the trust document and by the law. The designated successor trustee oversees this process, ensuring that the grantor’s intentions are faithfully executed. From cataloging and assessing the value of trust assets, to settling outstanding debts and tax obligations, to making final distribution of trust assets to the grantor’s desired beneficiaries, the successor trustee shoulders multifaceted responsibilities. The trustee has a fiduciary duty, requiring the trustee to fulfill the wishes of the grantor and act in the best interests of the beneficiaries.

Who typically oversees trust administration?

Trust administration is typically a private family matter overseen by the trustee, an individual explicitly named in the trust document by the grantor. This person assumes the responsibility of executing the grantor's intentions regarding the management and distribution of assets. The successor trustee becomes the central figure in the trust administration process, orchestrating tasks such as asset valuation, debt settlement, and distribution among beneficiaries. Their role is not only administrative but also serving as a fiduciary, requiring a careful and meticulous approach to ensure compliance with legal requirements and the specific provisions outlined in the trust document.

What does a trustee do?

The trustee's role during trust administration encompasses a broad spectrum of responsibilities. These include conducting a thorough inventory and valuation of trust assets, addressing outstanding financial obligations, and ultimately overseeing the distribution of assets to beneficiaries in accordance with the grantor's intentions. The trustee essentially acts as a custodian of the trust, ensuring a seamless transition from the grantor's legacy to the beneficiaries, all while adhering to the trust document since the trustee serves as a fiduciary, the trustee may be held liable for any breaches of fiduciary duties.

How long does trust administration typically take?

The duration of trust administration is contingent on various factors, making it challenging to provide a precise timeframe. Generally, trust administration is a far shorter and more desirable process than probate. Elements such as the complexity of the trust, the diversity of assets, and potential legal challenges contribute to the variability in timelines. In general, the process can extend from mere days to multiple months. It is rare for trust administration to extend beyond this point, making it a much more streamlined process than probate, due to the avoidance of extensive legal requirements, court supervision, and costs.

Locations We Serve

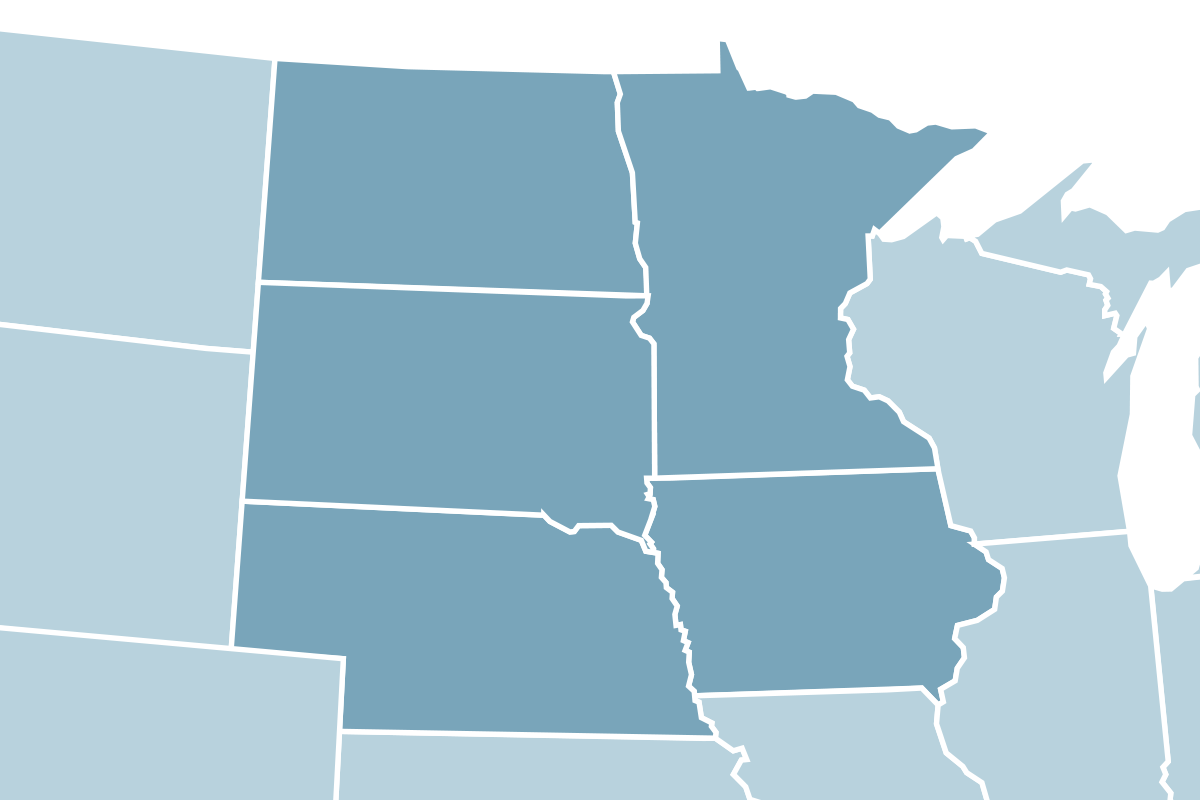

Legacy Law Firm offers legal services in estate planning, asset protection, elder law and trusts to individuals and businesses throughout the Midwest. We currently practice in these states:

- South Dakota

- Iowa

- Minnesota

- Nebraska

- North Dakota

Be Educated

Our team of trust attorneys in Sioux Falls is dedicated to turning your aspirations into reality and safeguarding your legacy. Committed to adding value in every way, we empower you with knowledge to make informed decisions and secure your future.

Contact Us

Whether you need help with probating an estate or administering a trust, we are here to assist you. Contact us today for a complimentary consultation.

Related Expertise

Read Our Blog

We’re committed to providing value at every turn. Check out our blog page for helpful resources.

-min.jpeg?width=500&height=286&name=AdobeStock_580196705%20(1)-min.jpeg)