Tax & Asset Protection Planning

When you are protecting your estate and family from taxes, there are many types of taxes that need to come into play when doing your planning: estate taxes, gift taxes, income taxes, real estate taxes, capital gains taxes, generation skipping transfer taxes, and depending on the state you live in, inheritance taxes and state estate taxes. Our Sioux Falls asset protection attorneys and tax attorneys are here to help.

Be Prepared

Sioux Falls Tax Lawyers

We can help you navigate the cobweb of taxes in our increasingly complicated tax environment. Estate and tax planning strategies can help make sure you and your loved ones are keeping more in your pocket. It's also critical in today's world to do asset protection planning. Bad things can happen to good people. Our Sioux Falls asset protection lawyers help make sure you and your family are protected. We can help protect your children's inheritance in case they get a divorce, go through a lawsuit, or get in a car accident and get sued. We can also protect assets for the surviving spouse from a predatory marriage if they get re-married after you are gone. It's not about what you make at the end of the day, it's about what you keep.

Our Sioux Falls attorneys at Legacy Law Firm have provided help to many clients in South Dakota, Iowa, Minnesota, Nebraska, and North Dakota from those who are just starting out to those who are well-established. Give us a call at 605-275-5665 or contact us online to find out more about the ways in which one of our Sioux Falls tax attorneys or asset protection lawyers can help.

Frequently Asked Questions

What is a gift tax?

The gift tax applies to gifts made while a person is living. A gift is considered a “gift” when assets are transferred to someone else and the person who gave them the asset is not paid or given full value in return. Generally, gift taxes are paid by the individual making the gift. Depending on where you live, you may be subject to both a state gift tax and the federal gift tax. The annual federal gift tax exclusion is the amount an individual may gift to each individual during the year without having to report a taxable gift. In 2025, the annual gift exclusion is $19,000 per donee. Any gift over this amount must be reported to the IRS. The lifetime federal gift exemption is the amount each individual may gift during lifetime without haing to pay gift taxes. In 2025, the lifetime gift exemption is $13.99 million. Any amounts exceeding the lifetime gift exemption is subject to a 40% gift tax.

What is an estate tax?

The estate tax is a tax on the value of a deceased individual’s gross estate calculated at death. Unlike the gift tax, which is applied during an individual’s lifetime, the estate tax is applied at death. Generally, estate taxes are paid by a deceased individual’s estate. Depending on where you live, you may be subject to both a state estate tax or an inheritance tax and the federal estate tax. In 2025, the federal estate tax is $13.99 million per person. Accordingly, spouses can pass to heirs a combined total of $27.98 million before facing estate taxes. Any amount exceeding this is subject to a 40% estate tax. It’s important to know that lifetime gifts reduce the exemption amount available for estate tax purposes.

Is the current gift and estate tax going to sunset in 2025?

The current Tax Act as it relates to gift and estate taxes is set to sunset in 2025. Accordingly, on January 1, 2026, the federal gift and estate tax exclusion is scheduled to decrease to $5 million indexed for inflation. This will decrease the current federal gift and estate tax exclusion to nearly half of its current amount. For those who want to do estate tax planning, it is important to begin the process as early as possible in case Congress doesn’t act to prevent the sunset from happening.

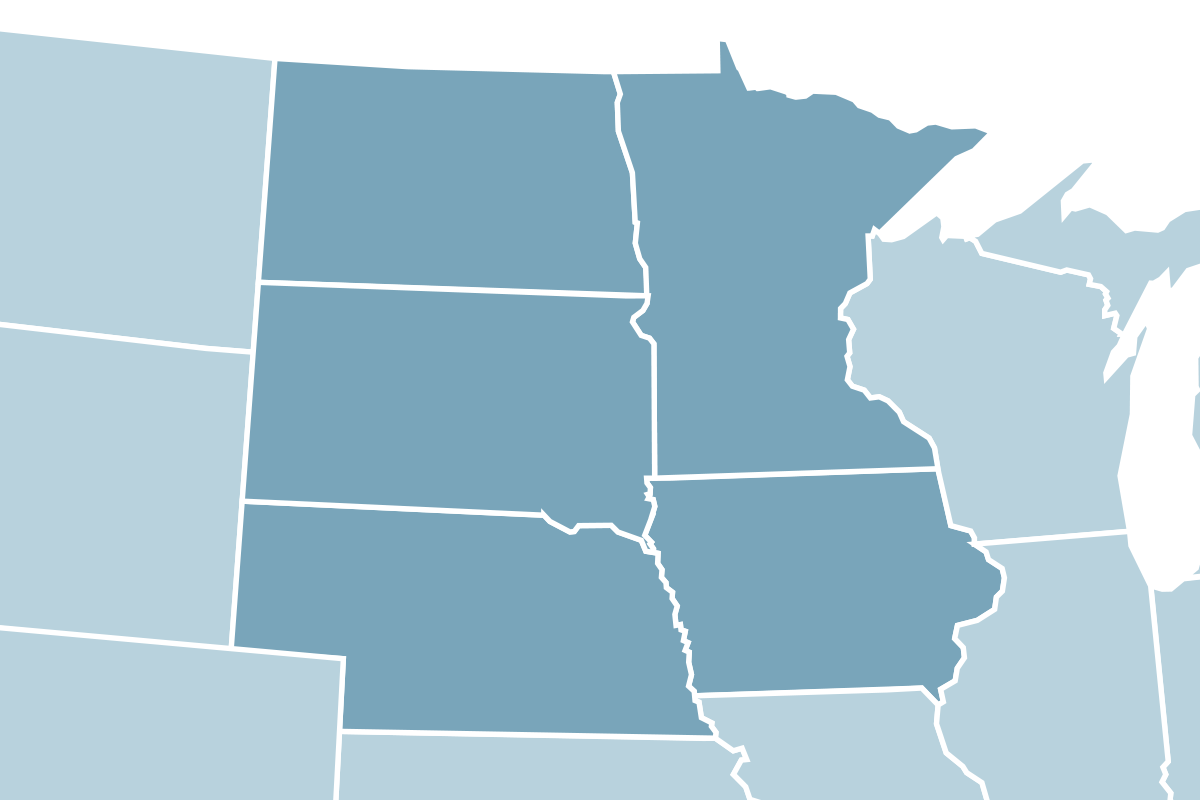

Locations We Serve

Legacy Law Firm offers legal services in estate planning, asset protection, elder law and trusts to individuals and businesses throughout the Midwest. We currently practice in these states:

- South Dakota

- Iowa

- Minnesota

- Nebraska

- North Dakota

Related Expertise

Read Our Blog